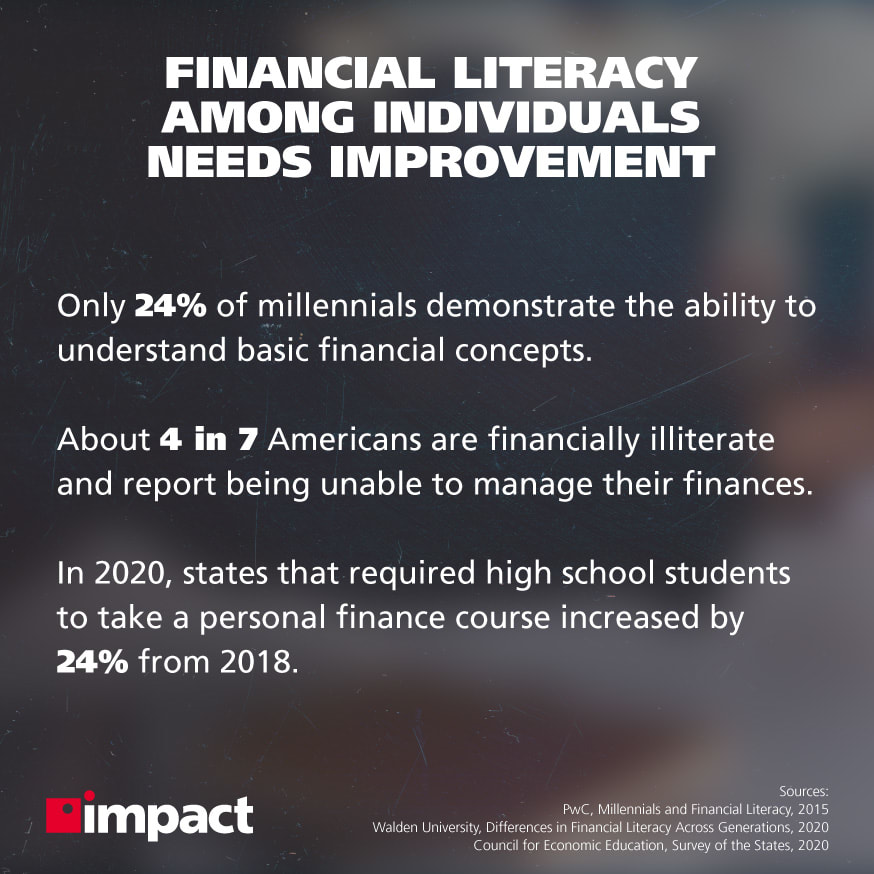

How can technology promote financial literacy? Financial literacy has never been more important, and yet, even in today’s digital age, many businesses and individuals struggle with understanding their finances.

For both individuals and organizations, particularly in the wake of the pandemic, having a good grasp of financial literacy is essential, and technology is in many ways allowing this to happen.

Today, we’re going to be taking a look at how technology is impacting financial literacy and what the outlook is for the future.

Here are just three ways technology from the web and beyond are impacting financial literacy for businesses and individuals alike.

1. Financial Resources are More Available Than Ever

Finances, in general, have become increasingly rooted in technology, from mobile banking to transferring money online, and yet while uptake of these technological initiatives has grown massively, literacy has struggled to keep pace.

Thankfully, resources online are plentiful, whether it’s online courses, videos, blogs, applications—whatever learning style works best for an individual, exists.

Previously, with financial information being less accessible, it would often be the case that individuals would rely on either advice from friends or family or personal experience.

Of course, today, with the increased availability of information pertaining to financial literacy, virtually anything can be learned from financial resources online.

With this increased availability, complex but important material is being covered across many day-to-day financial concerns, such as:

- How should I invest my Roth IRA?

- What is a no-closing-cost refinance and its uses?

- What is asset diversification?

- How should I use my credit card responsibly?

- How can I reduce my financial debt?

Some applications are harnessing the ability to “gamify” financial literacy in order to increase exposure to younger generations.

Through the increased exposure to new financial literacy opportunities and the additional mediums in which it’s available, more people of all ages are being exposed to a more well-rounded financial education and engagement opportunities, which can help them throughout their entire lives.

2. Businesses are Incorporating More Financial Technology

Similarly to finance on an individual level, business finances are becoming more reliant on technology as well.

Transactions are faster and more secure, and all the information is available in an instant with easy adoption into a business model.

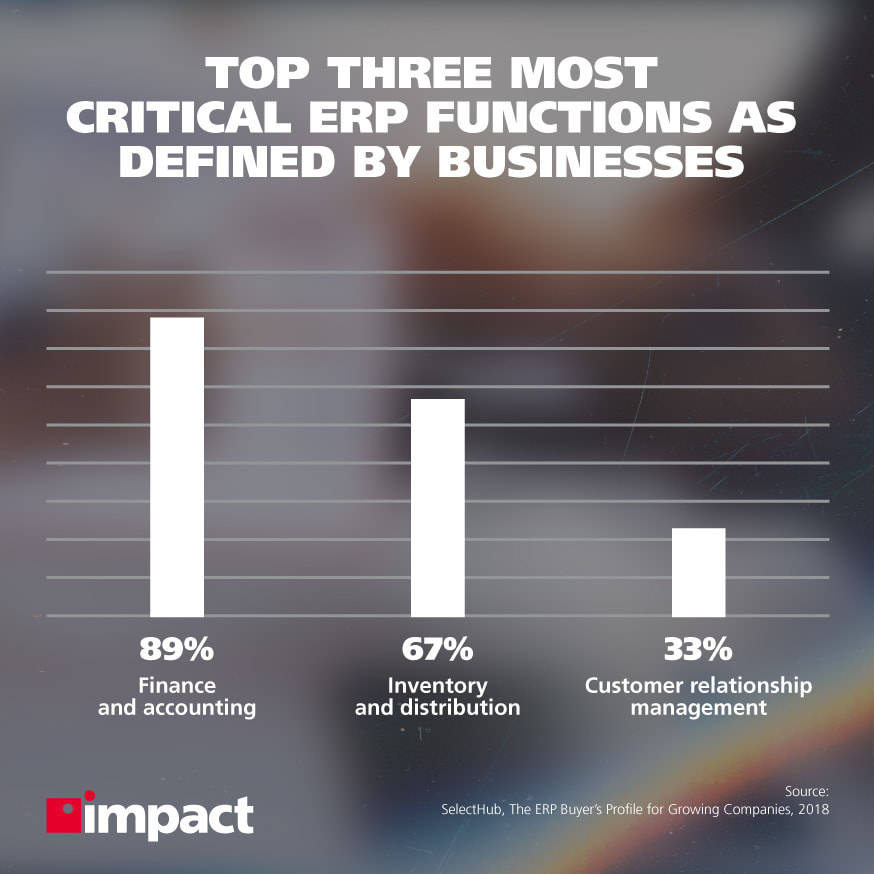

Many businesses are integrating their financial and accounting software and programs into their traditional enterprise resource planning (ERP) systems, which allows them to create models and predictive trends using their personal financial data.

Improvements in Gathering Financial Data are More Widely Available

One thing that makes this possible is the increased ability to gather financial data. With a large portion of businesses of all sizes primarily operating digitally, this information can be collected and aggregated easily and effectively.

This Financial Data is Then Used More Effectively

Once this data has been collected, it then has to be used correctly in order to provide any benefit.

There are many ways that businesses can harness the power of this data in order to better understand their current state and where they are headed in the future.

- Profit Tracking: Through understanding how your business earns its profits and the breakdown of its sources, it can help you better understand where the majority of your profits come from and your return on investment.

- Accounts Payable: Integrating your purchasing data with your accounts payable data can help you better monitor your cash flow and help you process invoices and make payments on time.

- Risk Management: Being able to use this collected data to predict, analyze, and better approach your financial future can greatly cut down on the risks that your business face, and allow you to plan your timeline more effectively and in greater detail.

In times of economic uncertainty, it’s more important than ever that your business is striving to find financial security.

By taking advantage of the financial information that already exists, and better integrating it into your current growth plans, you have an increased ability to predict and plan your financial future.

3. HR Offerings are Becoming More Expansive

As more employees begin to emphasize the importance of job perks and their quality of life, human resources (HR) departments have been evolving to provide a better level of care.

Instead of simply covering retirement plans, many now offer employee assistance programs, mental health support, and financial literacy education.

Many HR departments have been utilizing technology to provide their employees with increased financial education, especially in times of heightened remote work.

Just as businesses are struggling with the effects of the global pandemic, individuals are too, and organizations are with increasing frequency utilizing technology to meet these concerns.

HR departments are leveraging the use of applications and services aimed at increasing financial literacy rates, which can help employees better plan and manage their futures, in addition to offering short-term stress relief and helping them be more acclimated to their work environment.

By allowing people of all ages increased exposure to technology that improves financial literacy, these businesses are allowing employees to get a better handle on their individual financial situations.

Understanding the importance of financial literacy and the best ways to increase its rates improves positive benefits at both individual and company-wide levels.

In short, employees bring their financial concerns with them to work, whether the employer knows it or not.

By engaging them with tech that improves their financial literacy, they will be in more control of their own affairs, less stressed, more productive, and more focused.

Technology has a big influence on financial literacy and will continue to do so with tech platforms an ever-present part of daily lives. Investing in financial literacy is a shrewd decision for both businesses and individuals to make.

Subscribe to our blog to receive monthly insights into business technology and stay up to date with marketing, cybersecurity, and other tech news and trends.