Compliance in finance has always been a difficult topic—The banking and finance sector has been powered by manual work over decades now.

However, with businesses adopting digital technology for their working processes more than ever before, there has been a significant shift across almost every industries. This has resulted in the change in the approach of the financial sector as well, seeking to keep pace.

Many of them have introduced various innovative applications and solutions to enhance the banking experience by making it more seamless and effective, but this is mostly on the customer-facing end.

Meanwhile, in the backend, many processes are still outdated, which often proves to be a hassle for the employees.

Download free eBook: Understanding Workflow Automation

Reasons for Not Investing in Technology

For businesses that still operate using more traditional methods, typically involving manual processes for things like data entry, it’s significantly more difficult for them to the benefits of new IT services and technologies—and financial companies are no exception.

Most financial institutions are reluctant to do so as changing their whole infrastructure is not only costly, but also needs a lot of time and extensive planning for implementation and ongoing support.

Financial institutions rely heavily on customer trust and support and many organizations feel that sweeping changes to infrastructure is simply too big of a change, given the implications of a poor digital transformation project.

Just 23% of financial institutions view themselves as having digital capabilities that are better than their competitors, compared to 35% of businesses as a whole.

The hesitancy of finance firms to adopt digital transformation has led to increased interest in implementation now to catch up, but the reality of implementation is still an issue. While 54% have actively developed a strategy for digital transformation, only 14% of them are actually implementing it.

Most employees are novices in the field of technology, a common aspect of technology adoption that has to be addressed by all businesses. Hiring experts, training existing employees, and the disruption of removing legacy software is a time-consuming and expensive process.

Moreover, due to an already existing system or manual process for compliance in finance, along with employee familiarity with current processes, these expenditures seem unnecessary to many.

Most organizations do not want to take any chances with their compliance management process as that puts the company’s risk management technique in jeopardy.

Present Scenario

Keeping up with the norms of social distancing, banks and financial institutions have been forced to accelerate their digital plans.

Organizations who have remained reluctant to move towards digital platforms have had to face several consequences.

This is particularly the case with cybersecurity. For example, consider the uncomfortable reality that two-thirds of financial services firms have suffered a cyberattack over the course of 2020, with just under half reporting a rise in attacks since the start of the pandemic.

Cyberattacks can be (and often are) devastating to all businesses, let alone those in the finance industry who possess enormous amounts of very sensitive data. The protection of this information, for the purposes of compliance and security, has been put further into the spotlight for many finance firms in light of the pandemic and prompted many to adopt new solutions to protect themselves.

Despite lagging behind in compliance technology and digital transformation in general, more than a fifth (21%) of financial firms cite developing a digital transformation strategy as their top business priority.

Despite all these concerns, financial institutions have often not found themselves ready to support the technological infrastructure required to ensure their operations are fully digital to the extent they need to be.

Of course, the main reason for not investing in the digital initiatives required for the security features and compliance they need is simply because, for many, the perceived gains are not worth the investment—often without fully considering the adverse effects a cyberattack can cause.

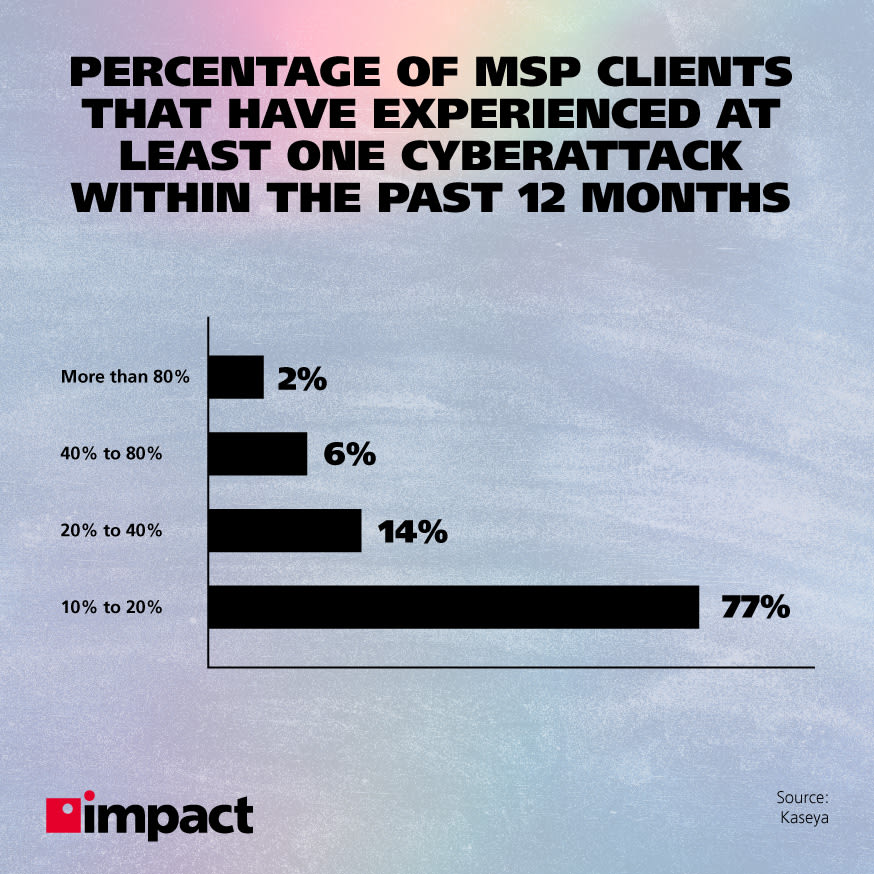

For 77% of the MSP respondents in a Kaseya survey, 10 to 20% of their clients have experienced at least one cyberattack within the 12 months prior to the survey. This reflects the state of affairs before the pandemic took hold, which has itself led to a vast increase in security incidents over the last year.