2020 has been a year full of surprises for businesses—some more unpleasant than others. The number of cyberattacks in particular has skyrocketed this year, leading many SMBs to reassess their cybersecurity investment plans and ask themselves whether they’re doing enough to protect their data.

We put together this infographic to take a look at how the market has been changing over the last few years and how businesses have been responding to the rising incidence of cyberattacks. Check it out!

Businesses are treading a tight rope in 2020—acknowledging that they must counter cyberthreats but taking a more modest approach to investment compared to 2019. It is clear that these threats aren’t going anywhere and spending trends appear to indicate a robust but patient response to security spending.

Impact’s comprehensive cybersecurity offering takes care of your cyber needs with a tailored program of hand-picked solutions to combat modern threats without having to incur the costs of an in-house team. To learn more about how we can help with your security, visit impactmybiz.com/cybersecurity.

Infographic written copy:

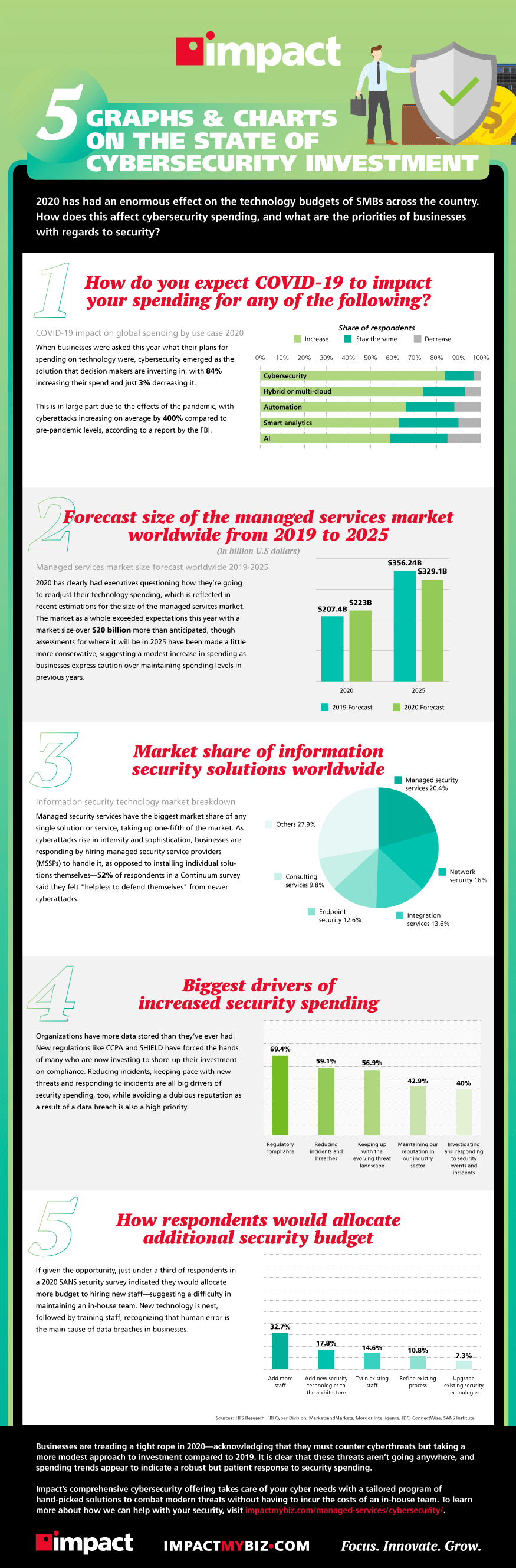

2020 has had an enormous effect on the technology budgets of SMBs across the country. How does this affect cybersecurity investment, and what are the priorities of businesses with regards to security?

Figure 1

When businesses were asked this year what their plans for spending on technology were, cybersecurity emerged as the solution for which decision makers are investing in, with 84% increasing their spend and just 3% decreasing it. This is in large part due to the effects of the pandemic, with cyberattacks increasing on average by 400% compared to pre-pandemic levels, according to a report by the FBI.

Figure 2

2020 has clearly had executives questioning how they’re going to readjust their technology spending, which is reflected in recent estimations for the size of the managed services market. The market as a whole exceeded expectations this year with a market size over $20 billion more than anticipated, though assessments for where it will be in 2025 have been made a little more conservative, suggesting a modest increase in spending as businesses express caution over maintaining spending levels in previous years.

Figure 3

Managed security services has the biggest market share of any single solution and service, taking up one-fifth of the market. As cyberattacks rise in intensity and sophistication, businesses are responding by hiring Managed Security Service Providers (MSSPs) to handle it, as opposed to installing individual solutions themselves—52% of respondents in a Continuum survey said they felt “helpless to defend themselves” from newer cyberattacks.

Figure 4

Organizations have more data stored than they’ve ever had. New regulations like CCPA and SHIELD have forced the hands of many, who are now investing to shore-up their investment on compliance. Reducing incidents, keeping pace with new threats, and responding to incidents are all big drivers of security spending, too, while avoiding a dubious reputation as a result of a data breach is also a high priority.

Figure 5

If given the opportunity, just under a third of respondents in a 2020 SANS security survey indicated they would allocate more budget to hiring new staff—suggesting a difficulty in maintaining an in-house team. New technology is next, followed by training staff; recognizing that human error is the main cause of data breaches in businesses.